U-Mart2001

In order to evaluate the U-Mart System formally, machine agent programs had been invited prior to the experiment to do pre-experiments. Four types of time series (up, down, reverse, oscillate) were used in the experiment and participating machine agents were ranked based on the results. All such machine agents were set to connect to the server via a network and to collect information or order real-time. It took about two hours per trial, even with the machine agents.

₯Date |

August 25, 2001 | |

₯Place |

SICE Natsuno Gakko, INTEC Oyama Training Center | |

₯Participants |

14 teams (39 agents) | |

₯Agent type |

Machine and Human |

![]()

- # Sessions per day: 4 times

- Session interval: 15 seconds

- Trading period: 60

- Total # sessions: 240 times

- Two experiments were conducted per time series in advance (with/without random agents).

Total ten experiments were conducted during the session.

yMachine and Humanz

| Team | University | Member ID |

| Koyama | Kyoto Sangyo University | mP |

| Kobayashi | Tokyo University | m2`m6 |

| Ariyama | Osaka Prefecture University | m7`m8 |

| Arai | Chiba Institute of Technology | m9 |

| Ihara | Chiba Institute of Technology | m10 |

Arima |

Kyoto University |

m11 |

Inoue |

Kyoto University |

m12`m20 |

Vincent |

National Defense Academy in Japan |

m21 |

Kawauchi |

National Defense Academy in Japan |

m22`m25 |

Ishii |

Tokyo Institute of Technology |

m26`m30 |

Kumei |

Osaka City University |

m31`m33 |

Goto |

Osaka City University |

m34 |

Ueda |

Osaka City University |

m35 |

| Hashimoto | Osaka City University |

m36`m39 |

Case 1: Default sequence Profit Upper ranks Agent

Without random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | DayTrade | m34 | Goto | Osaka City University |

| No.2 | Inoue7 | m18 | Inoue | Kyoto university |

| No.3 | Inoue6 | m17 | Inoue | Kyoto University |

With random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | Inoue6 | m17 | Inoue | Kyoto University |

| No.2 | DayTrade | m34 | Goto | Osaka City University |

| No.3 | Test2@Strategy | m3 | Kobayashi | Tokyo University |

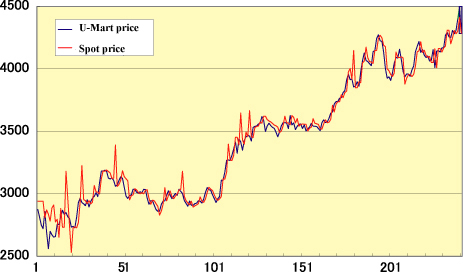

Case 2: Upper sequence Profit Upper ranks Agents

Without random agents

| Rank | Agent name |

Member ID | Team | University |

| No.1 | Inoue5 | m16 | Inoue | Kyoto University |

| No.2 | Test2 Strategy | m3 | Kobayashi | Tokyo University |

| No.3 | DayTrade | m34 | Goto | Osaka City University |

With random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | Inoue6 | m17 | Inoue | Kyoto University |

| No.2 | DayTrade | m34 | Goto | Osaka City University |

| No.3 | Test2 Strategy | m3 | Kobayashi | Tokyo University |

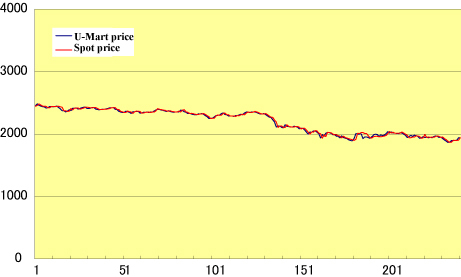

Case 3: Down sequence Profit Upper ranks Agents

Without random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | Inoue6 | m17 | Inoue | Kyoto University |

| No.2 | Inoue7 | m18 | Inoue | Kyoto University |

| No.3 | Test3 Strategy | m4 | Kobayashi | Tokyo University |

With random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | ZaimaStrategy | m11 | Arima | Kyoto University |

| No.2 | Random Trade | m42 | U-Mart-Kit | @\\\\\\\\\\\\ |

| No.3 | Inoue4 | m15 | Inoue | Kyoto University |

Case 4: Reverse sequence Profit Upper ranks Agents

Without random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | Fumi1 | m36 | Hashimoto | Osaka City University |

| No.2 | Fumi3 | m38 | Hashimoto | Osaka City University |

| no.3 | Sonkiri | m24 | Kawauchi | National Defense Academy in Japan |

With random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | Random Trade | m41 | U-Mart-Kit | @\\\\\\\\\\\\ |

| No.2 | Random Trade | m40 | U-Mart-Kit | @\\\\\\\\\\\\ |

| No.3 | Random Trade | m42 |

U-Mart-Kit |

@\\\\\\\\\\\\ |

Case 5: Oscillate sequence Profit Upper ranks Agents

Without random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | DayTrade | m34 | Goto | Osaka City University |

| No.2 | Inoue7 | m18 | Inoue | Kyoto University |

| No.3 | Inoue6 | m17 | Inoue | Kyoto University |

With random agents

| Rank | Agent name | Member ID | Team | University |

| No.1 | Inoue6 | m17 | Inoue | Kyoto University |

| No.2 | DayTrade | m34 | Goto | Osaka City University |

| no.3 | Test2 Strategy | m3 | Kobayashi | Tokyo University |

![]()

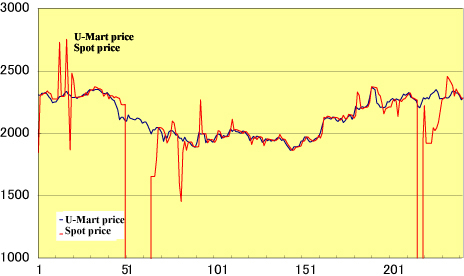

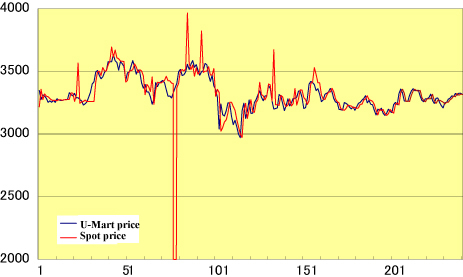

yU-Mart2001z

EPrices were more stable than in Pre U-Mart 2000

EThere were less incompetent participants

EThere were more economic savvy participants

EStrategic types, the majority participating agents, must be mounted with the limit.

EEven with the preferable conditions mentioned above, the market had a turbulent sometimes.

ETurbulent occurred often from the midpoint to the ending of the session.

(At Pre U-Mart 2001, turbulent occurred from the beginning.)