U-Mart2002

Many students including those from Osaka Sangyo University and Chuo University participated. Students of Osaka Sangyo University and Chuo University had experienced trading using U-Mart many times in classes. So those universities regarded that this open experiment was an opportunity to understand the results of their educations. After the experiment, a joint seminar was organized by participant universities for academic exchange among students.

¥Date |

November 5, 2002 | |

¥Place |

Department of Economics, Osaka City University Co-hosted by SICE and Japan@Society of System@Engineering |

|

¥Participants |

7 teams with machine agents and

12 teams@with human agents |

|

¥Agent type |

Machine and Human |

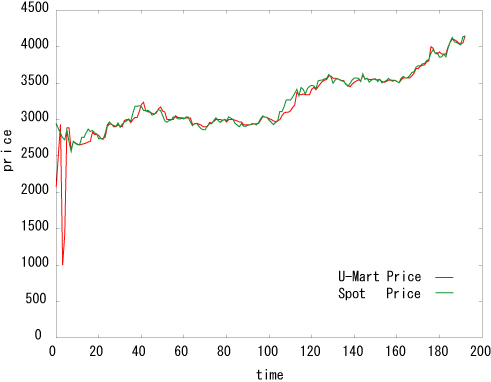

- # Sessions per day: 8 times

- Session interval: 10 seconds

- Trading period: 24

- Total # Sessions: 192 times

yBreakdown of human agentsz

¡Osaka Sangyo University: @8 teams, total 24 member

yAmong thosez: Undergraduates who had used the U-Mart System in class for half a year, and Several "speculators"(maybe)

¡Kyoto University: @1 team, total 3 member

yAmong thosez:@Graduates and undergraduates who were not familiar with the U-Mart system and futures market trading.

¡Chuo University: 1 team, total 3 member

yAmong thosez:@Undergraduates who had experienced the U-Mart System and developed machine agents

yMachinez

| Team | University | Member ID | Description |

| Ishiyama | Chuo University | m1`m3 | EStrategic trading posing as an amateurEin the market: Kawasaki EDecisions based on George Sorosfs Theory of Reflectivity and Williams %R: Kim EDecisions based on the Oscillation Trend: Ishiyama |

| Kobayashi | Chuo University | m4`m6 | EStochastic Theory (revised): Harada E Day-to-Day Price Movements Psychological Line: Kobayashi EStochastic Theory: Nakata |

| Nakajima | Osaka City University | m7`m9 | E Kaubakka E Price Maker E Selling/buying according to price range |

| Sawa | Osaka City University | m10`m12 | ESophisticated clients with three agents working in coordination EEach agent had 7 strategies: ECountermeasure against losing at the last count, semi-simple regular siege, RSI Analysis, series method, short-to-medium-term average method, regular siege, Williams %R E Duration of search: 14 days E Each participant implemented every strategy --> Results were reported to the server. EDuration of using optimum strategy: 8 days E After trials of the 7 strategies, decided the best one and used it. E Duration of taking countermeasure against losing at the last count: 2 days E Tried to secure position near zero |

| Kobayashi | Tokyo University | m13`m15 | EDay trade type E Trend type E Pseudo-arbitrage Type |

| Kanai | Osaka City University | m16`m18 | E Arbitrage trading between spot and futures ESimple averaging sell E Averaging buy employing dollar cost averaging method ETeam working: When the market was on its upward course, (3) would make profit and (2) would hedge loss, and in opposite condition, those would take opposite roles respectively.(1) would make a profit under any condition only if an arbitrage opportunity given. |

| Ariyama | Osaka Prefecture University | m19`m21 | EOn-line fuzzy learning A E On-line fuzzy learning B E Neural network |

yHuman agentsz

| Team | University | Member ID | Member name |

| Taniguchi A | Osaka Sangyo University | m31`m33 | Ogasawara, Tabuchi, Inoue |

| Fudaikeihokonsei | Osaka Prefecture University & Osaka University of Economics and Law |

m36`m38 | Ariyama, Fukase, Kitano |

| Taniguchi G | Osaka Sangyo University |

m39`m40 | IharaCTakachi |

| Chuo 2002 | Chuo University | m34Em41Em42 | Nakata, Kobayashi, Harada |

| Chuo P | Chuo University | m44`m46 | Kim, Kawasaki, Ishiyama |

| Taniguchi F | Osaka Sangyo University | m47`m49 | Goto, Yokoyama, Kato |

| The Sai | Osaka Sangyo University | m50Em60Em61 | Sai, Ichikawa, Fujii |

| Kyotodai | Kyoto University | m51`m53 | Shinagawa, Endo, Lee |

| Taniguchi B | Osaka Sangyo University | m55`m57 | Irifune, Sugihashi, Matsuo |

| Taniguchi B | Osaka Sangyo University | m63`m65 | Kubosaki, Tanaka, Sen |

| SUPER M | Osaka Sangyo University | m67`m69 | Emura, Sakamoto, Okoshi |

| TaniguchiE | Osaka Sangyo University | m71`m73 | Ota, Maekawa, Hayashi |

Agent

| Rank | Agent name | Member ID | Team | University | CASHi\j |

| No.1 | Ariyama02 | m20 | Ariyama | Osaka Prefecture University | 7,412,344,000

|

| No.2 | Ariyama01 | m19 | Ariyama | Osaka Prefecture University | 5,226,312,000 |

| No.3 | Kato | m49 | Taniguchi F | Osaka Sangyo University | 2,271,369,000 |

| No.4 | Tabuchi | m32 | Taniguchi A | Osaka Sangyo University | 2,090,150,000 |

Team

| Rank | Agent name | MemberID | Team | University |

| No.1 | Ogasawara, Tabuchi, Inoue | m31`m33 | Taniguchi A | Osaka Sangyo University |

| No.2 | IharaETakachi | m36`m40 | Taniguchi G | Osaka Sangyo University |

| No.3 | Team_TK01`03 | m13`m15 | Team_TK | Tokyo University |

| No.4 | Isiyama01 | m 1`m 3 | Ishiyama | Chuo University |

| No.5 | ItaEyoseEcom01`03 | 10`m12 | ItaEyoseEcom | Tokyo Institute of Technology |

|

yU-Mart2002z |

yResult of U-Mart 2002z |