Actual implementation example at Osaka Sangyo University

Summary : Experiment with human (students of Osaka Sangyo University) agent

・As a feature of U-Mart: GUI especially developed for a research project in which

humanities and science (machine human agents) are integrated, and easy to handle for

human agents.

・Experiments including preliminary ones were held during May to July ten times

・28 of the human agents and 3 random machine agents participated

Purpose of experiments

・To know the influence of board information disclosure on trading

・Verify efficiency of the market (analysis of institutional issues)

・To know relationships among information disclosure, trade

volume, and price movement

・ Specialists in the NY Market secure opportunities for profit

gain by monopolizing board information or seller/buyer and the

quantity information.

Preparation and conditions of experiment

・Learned about securities market and futures market

・Learned about U-Mart Market and how to use GUI

・Creation of formats used for the experiment

・Itayose interval: 10 seconds Duration: 50 minutes per experiment

・Participants were divided into two groups: those where their

board information was disclosed, and those not disclosed.

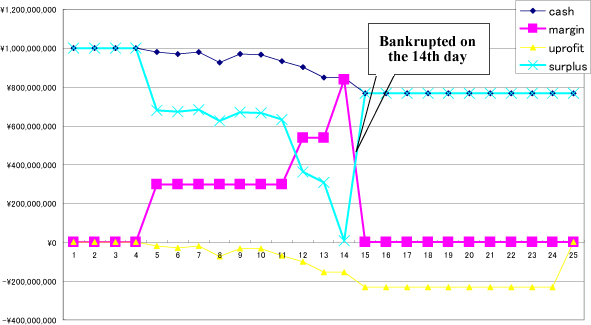

【Causes of bankrupt】

Total experiment: 28 participants x 4 cycles = 112. Among those, there were 7 bankruptcy cases.

・When the participants got excited, they tended to have input errors (for example, quantity and price were inputted

in opposite fields). There were two bankruptcies in that way.

・ Because the participants were not able to cut losses, they failed in position management. There were five

bankruptcies that way.

・ Human agents tended to hope that the price would reverse eventually.

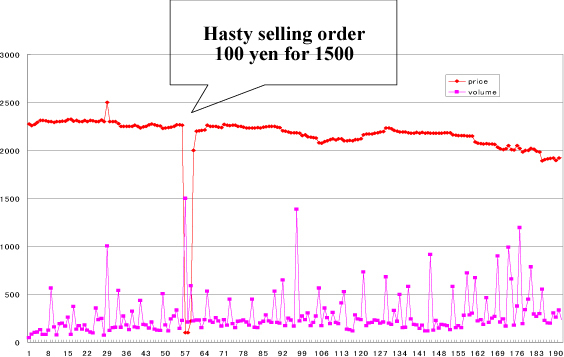

Example of the experiment

Operation example of a student